Short GBPUSD @ 1.7498...stop 1.7528, take profit @ 1.7468 ... 5wma/20wma cross

Forex Trade Review:

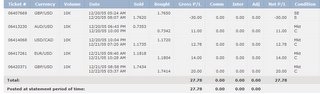

I did quite a few trades in the past few days trying to catch the short term moves in this choppy market. It's been great for testing out a few ideas as far as my methods on support and resistance, fundamental discretion, and time filters and discretion. Here's my record from 12/06/05:

Currency Date/Time Entered Sold/Bought Bought/Sold Gross P/L Net P/L

USD/JPY 12/05/05 08:36 AM B 121.14 S 120.94 16.51 15.38

NZD/USD 12/06/05 07:07 PM B 0.7136 S 0.7160 -24.00 -24.00

USD/CAD 12/06/05 08:03 PM S 1.1576 B 1.1619 -29.29 -29.29

GBP/USD 12/06/05 08:05 PM S 1.7383 B 1.7353 30.00 30.00

EUR/JPY 12/07/05 09:27 AM B 141.71 S 141.86 12.39 12.39

NZD/USD 12/07/05 07:45 PM S 0.7031 B 0.7011 20.00 20.00

USD/CAD 12/07/05 10:07 PM S 1.1590 B 1.1614 -20.66 -20.66

EUR/JPY 12/08/05 07:58 AM S 141.82 B 142.05 -19.07 -19.07

NZD/USD 12/08/05 08:51 AM S 0.7004 B 0.7018 -14.00 -14.00

USD/JPY 12/08/05 11:59 AM B 120.32 S 120.32 0.00 0.00

Total: -28.12 -29.25

Now the first thing that comes to mind when i look at this is, "man, i'm trading way too much!" The next thing is obviously my losses on average are larger than my wins...roughly 21 average loss and a 19 pip average gain. And I have a 4:5 win/loss ratio. One of the important lessons I hope will stick in my head is from the 24 pip loss on NZD/USD, which is to always check the news before you get into a trade. Well, the news on this pair at the time was unexpected, but I have it in my head now to always see what's happening before getting in. I hope this review helps someone. If anyone has any questions or comments feel free to leave a comment or send me an email at tradervlad@gmail.com